Hospital

Healthcare Industry

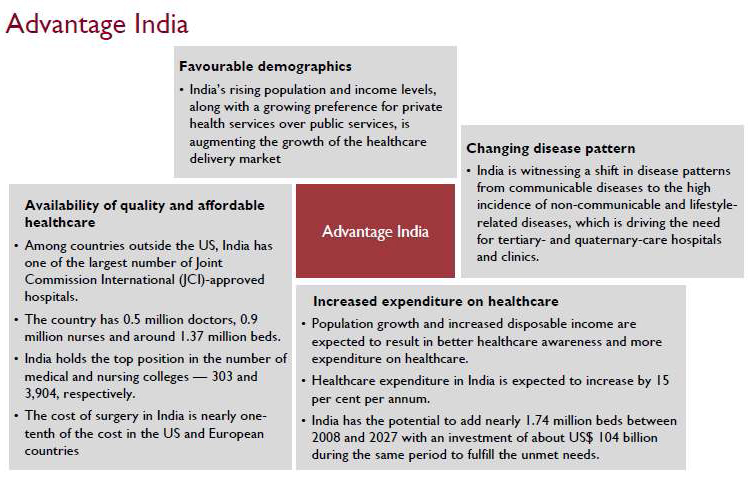

The Indian Healthcare sector is a sunshine sector of Indian economy with promising growth potentials. It is one of the prominent contributors to the country’s gross domestic product (GDP) having attracted large number of players- domestic as well as international – during the past few years. Highly qualified doctors and scientists, state-of-the-art technology and low costs have helped India become an attractive global destination for medical tourism, clinical studies, and research and development (R&D) programs. The sector comprises the hospitals and allied sectors such as diagnostics and pathology, medical equipment and supplies, and medical tourism.

Healthcare Industry Segments

- Hospitals;

- Pharmaceuticals;

- Diagnostic centers; and

- Ancillary services such as health insurance and medical equipment.

Classification of Healthcare Facilities

On the basis of types of services rendered and the complexity of the ailment, hospitals can be classified as follows:

- 1. Primary care facilities (including dispensaries)

- 2. Nursing homes

- 3. Secondary care hospitals

- a. General secondary care hospitals

- b. Specialty secondary care hospitals

- 4. Tertiary care hospitals

- a. Single specialty

- b. Multi-specialty

- 5. Quaternary care hospitals India is characterized by: a government sector that provides publicly financed and managed curative, preventive and promotive health services from primary to tertiary level throughout the country free of cost to the people and a fee-levying private sector that plays a dominant role in the provisioning of curative care.

Healthcare Facilities in India

The Public Healthcare in India

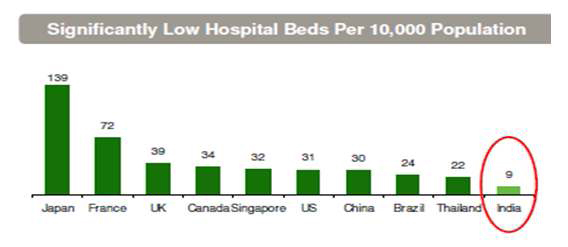

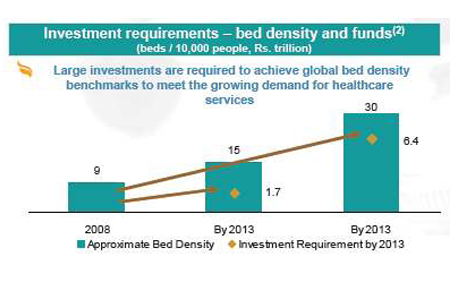

The public health infrastructure of India has grown since independence, but is is yet to match the basic healthcare facilities in many other countries. While in 1947 the number of hospitals beds was 3.2 per 10,000, the present number of 9 per 10,000 in commendable but still far behind those of other developing countries.

Private Sector contribution to Healthcare in India

At the time of independence only about 8 percent of all qualified modern medical care was provided by the private sector. But over the years the share of the private sector in the provision of healthcare has at about 80 percent of all outpatient care and about 60 percent of all in-patient care. Over 75 percent of the human resources and advanced medical technology, 68 per cent of an estimated 15,097 hospitals and 37 per cent of 623,819 total beds in the country are in the private sector. (Source: Annual Report, September 2010, Ministries of Health and Family Welfare)

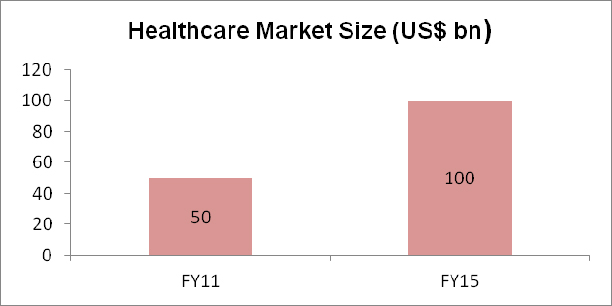

Healthcare Market Size in India

The US$ 50 billion-a-year health care industry has grown rapidly and is now the second-largest servicesector employer in the country, providing jobs to about 4.5 million people directly or indirectly. The Indian healthcare sectors will double its size to US$ 100 billion by 2015, according to ratings agency Fitch. As per a recent CII-McKinsey report, the growth of the healthcare sector can contribute 6 to 7 per cent of gross domestic product (GDP) and increase employment by at least 2.5 million by 2012.

Healthcare Trend

1. Players expanding to Tier II and Tier III along with Urban Cities.

- In view of the demand for private healthcare across tier-II and tier-III cities, the GoI has allowed the private sector to establish hospitals in these cities. As an indirect benefit extended by the GoI, the tax burden on these hospitals has also been relaxed for some years.

- There is a substantial demand for high-quality and specialty healthcare services in these cities, with two advantages for operators:

- i. Low Cost Model

- ii. High Patient Turnover

- Some of the Key players such as Fortis and Apollo have announced their plans to build more hospitals in urban as well as tier-II and tier-III cities in future.

2. Players Exploring New Models

- Traditionally, hospitals have been considered to be capital-intensive businesses with long gestation or breakeven periods.

- Players have been exploring models such as management contracts and public-private partnerships (PPP).

3. Players Targeting New Segments

- There is an increasing demand for health management plans for corporate employees, which is providing organised players with an additional revenue stream.

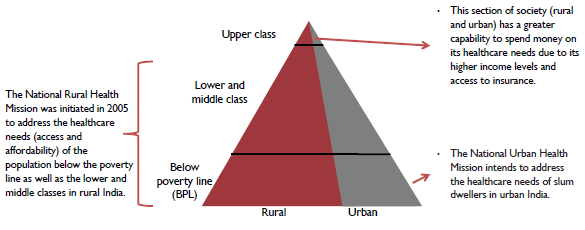

- The rural healthcare sector is also on an upsurge. No. of Sub Centres existing as on March 2010 increased from 146,026 in 2005 to 147,069 in 2010.

- India’s share in the global medical tourism industry will reach around 3 per cent by the end of 2013. Medical tourism is expected to generate revenue around US$ 3 billion by 2013, growing at a CAGR of around 26 per cent during 2011–2013.

- Hospital trade is a growing business opportunity for other sectors such as food retail as some large hospitals are getting almost 1,000-1,500 outpatients per day and visitors for inpatients who are also potential customers.

- With 3G there are possibilities of remote treatment and diagnosis of patients through mobile phones. Also, some telecom operators and value-added service developers are considering usage of mobile phones for diagnostic and treatment support, remote disease monitoring, health awareness and communication.

Key Growth Drivers of Healthcare Sector

The growth in demand for healthcare delivery services will be driven by a combination of various factors including changing demographics, increasing income levels, and greater health awareness and increasing health insurance coverage.

I. Increasing Expenditure on Health care

- a. India’s spent on healthcare is expected to be 8 per cent of GDP by 2012, from 5.5 per cent in 2009. Private sector expenditure in the healthcare segment is expected to reach US$ 45 billion by 2012.

- b. The growth of the healthcare sector can contribute 6 to 7 per cent of gross domestic product (GDP) and increase employment by at least 2.5 million by 2012.

- c. The Andhra Pradesh government has successfully implemented the US$ 59.68 million Health Management Project funded by the Department for International Development (DFID) of the UK. Other states as well are considering implementing similar models.

II. Demand and Supply Gap

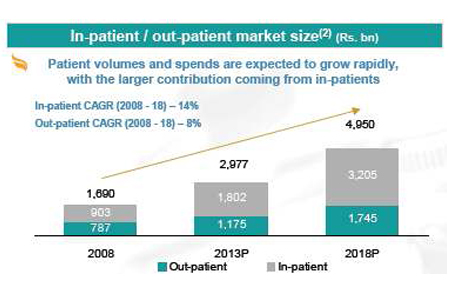

- a. The healthcare delivery market in India is at a nascent stage with high demand and growth potential driven in surge in number of treatments and the rise in cost per treatments.

- b. There is a growing demand for improved public health infrastructure due to the country‘s high population and increasing disease profile.

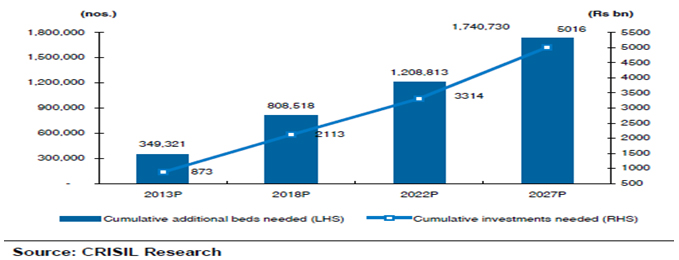

- c. Gap between the bed required and investment needed.

Source – Crisil research hospitals Annual review – Aug 2009

Source – Crisil research hospitals Annual review – Aug 2009  Source WHO – World Health Statistics, 2011

Source WHO – World Health Statistics, 2011 III. Preference for private treatments

- a. In India, private healthcare accounts for nearly 80 per cent of the country‘s total healthcare expenditure, although it is more expensive than public healthcare services.

- b. The preference for private healthcare can be attributed to better perceived quality and accessibility.

IV. Change in Demographics

It is expected that population growth in India will increase the demand for additional beds in future. India’s populations predicted to grow form approximately 1.2 billion in 2010-11 to over 1.4 billion by 2026. Life expectancy is also increasing, further increasing the demand for beds. The proportion of people over 60 years is also expected to increase to over 12% form current level of approximately 8%.

V. Rising Income

There has been a rapid growth of middle and upper classes, particularly the urban middle class segment which accounts for a majority of healthcare spending in India. VI. Rising health awareness With the rise in literacy levels across the country and growing awareness, it is expected that a greater percentage of the population will recognized the need for quality preventive and curative.

VII. Changing Disease Profile

As a result of changing demographics (the most significant change being an increase in the percentage of the population in the 30-60 age groups, from approximately 32.3% in 2007 to approximately 40% by 2026), and rising incomes (a greater percentage of households earning more than Rs. 200, 000 per annum), the incidence of lifestyle related diseases such as diabetes and hypertension are expected to increase.

VIII. Healthcare Insurance Coverage

According to CRISL, over 95% of India’s private healthcare expenditure is paid by out-ofpocket expenditure as health insurance coverage is under 5%.

IX. Medical Tourism

Medical tourism has gained momentum over the years and India is fast emerging as a major medical tourist destination. The Indian medical tourism industry is poised to grow at 30 percent annually, primarily driven by world-class healthcare services that are offered at a fraction of the overall cost, compared with western countries.

Challenges

Besides the financial performance of hospitals, it is important to comprehend other challenges to be faced by the hospitals. As compared to other industries, hospitals as an organization face different and unique challenges:-

- They have complex operation so that they need to provide appropriate quality of care, deal with humanitarian issues, tackle ethical dilemmas and handle emotional problems.

- Assessment of (a) viability and sustainability of its operations, (b) significance of its cost recovery mechanisms, (c) operations and financial risks etc.

- Competition in health care sector is intensifying with more and more hospitals being set up with intensive use of technologies. To keep operations sustainable, they need to focus on pricing of their services and capacity utilization.

- There are no high- end hospital equipment manufacturing and healthcare technology firms in India. Most of the equipments are imported and are of high value.

- Penetration of health insurance in India is still low. In the absence of insurance, the financial barriers to health care are high. This has implications for utilization of health services.

Multispecialty Hospital Project

a. Procurement of land

The company owns an area of approximately 3.26 acres (approx) inclusive of 0.76 acres of approach road, Covered Area 10117 Sq. Mts. On which the 175 bed Hospital will be constructed.

b. Feasibility of Project

The company feasibility report has been prepared by "Medium Health Care Consulting"

c. Regulatory approvals

Application filed for CLU with detailed Project report and is expected anytime, Forest Clearances obtained, Estimated Project Cost is INR 6290 Lacs (excluding land already in place).

d. Brand Tie up

MOU signed with Indo American Hospital Management (IAHM)

e. Commencement of construction

Estimated date for commencement of construction is January, 2012. Estimated opening of the Hospital in July 2013)

f. Concept and Features

175 bed (Approx) Multi Specialty Hospital with Indo American Hospital Management (IAHM) as the technical and management expert on an area of approximately 3.26 acres (approx) inclusive of 0.76 acres of approach road, Covered Area 10117 Sq. Mts.